new jersey 529 tax credit

I have what should be a simple question but even the state cant give me a definitive answer. It establishes a partnership between the Governor and the Legislature for the use of the federal aid New Jersey received from the American Rescue Plan.

New Jersey Provides Tax Deduction For College Savings Plan Contributions

New Jerseys Higher Education Student Assistance Authority HESAA can provide taxpayers with gross income of 75000 or less a one-time grant of up to 750 matched dollar for dollar on an initial deposit into a New Jersey Better Educational Savings Trust.

. New Jersey offers tax benefits and deductions when savings are put into your childs 529 savings plan. Heres what you should do to be confident your child will qualify for the scholarship. The New Jersey College Affordability Act allows for New Jersey taxpayers with gross income of 200000 or less to qualify for a state income tax deduction for contributions into an NJBEST plan of up to 10000 per taxpayer per year beginning with contributions made in tax year 2022.

Students and their families can use the tax-advantaged 529 savings accounts to pay tuition and loan expenses. The law also provides a maximum of 750 in matching funds for initial deposits into newly created NJ BEST accounts for taxpayers who earn up to 75000. The proposed state budget includes a new state tax deduction for contributions of up to 10000 into an NJBEST account for families.

Unfortunately New Jersey does not offer any tax benefits for socking away funds in a 529 account for your child. 529 Tax Benefits for New Jersey Residents. A 529 plan is designed to help save for college.

The New Jersey College Affordability Act allows taxpayers with household adjusted gross. There is no credit or deduction at the federal level for contributing to a 529 plan but this type of savings account is considered to be tax-favorable as earnings that come from 529 plans are not subject to federal income tax when used for qualified educational expenses. For my federal return I claim the full 2500 American Opportunity Tax.

In total they can contribute a maximum of 305000. Direct this New Jersey 529 plan can be purchased directly from the state. 36 rows Taxpayers in over 30 states may claim a state income tax deduction or.

The benefit would only be available to households with an annual income of 200000 or less. If you use the money for qualified. Managed and distributed by Franklin Distributors LLC an affiliate of Franklin Resources Inc which operates as Franklin Templeton.

The New Jersey College Affordability Act allows for a state tax deduction for contributions into a Franklin Templeton 529 College Savings Plan of up to 10000 per taxpayer per year with gross income of 200000 or less beginning with contributions made in tax year 2022. NJBEST 529 College Savings Plan is a traditional NJ 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified education expenses. New York is one of 34 states and the District of Columbia that offer residents a tax deduction or tax credit for 529 plan contributions.

This is what the New Jersey Administrative Code excerpted in the 529 plan disclosures says you have to do. In New Mexico families can deduct 100 of their contributions to New Mexicos 529 plan on their state taxes. The proposal includes a provision to allow New Jersey taxpayers to deduct 529 plan contributions of up to 10000 per year from state taxable income.

In 2022 New Jerseys plan NJBEST joins the majority of states that offer residents an income tax deduction or credit for contributions to the state plan. The budget deal creates new tax deductions for contributions of up to 10000 into an NJ Better Education Savings Trust 529 account for households earning up to 200000. NJBEST had previously been criticized.

Before you invest in New Yorks 529 Direct Plan consider whether your or the beneficiarys future students home state offers any state tax or other benefits that are only available for investments in that states 529 plan. New York families can reduce their tax liability by 5000 individual filers or 10000 married joint filers when they contribute to a. Contributions to such plans are not deductible but the money grows tax-free while it remains in the plan.

You pay only 120 in fees per year for every 1000 that you invest 012 total annual asset-based fee. Section 529 - Qualified Tuition Plans. It delivers tax relief by expanding tax credits for families rebates for homeowners deductions for veterans and aid to make college and retirement more affordable.

NJBEST New Jerseys 529 College Savings Plan is offered and administered by the New Jersey Higher Education Student Assistance Authority HESAA. New Jersey does not provide any tax benefits for 529 contributions. 529 plan tax deduction.

Thankfully NJ residents can open an account in any other state that lets them. 07 MarNJ tax treatment of 529 Plan earnings. Because New Jersey law incorporates the provisions of IRC section 529 New Jersey follows the federal expansion and considers a withdrawal from an IRC section 529 savings plan used for tuition at private religious elementary and secondary schools a qualified higher education expense for New Jersey Gross Income Tax purposes.

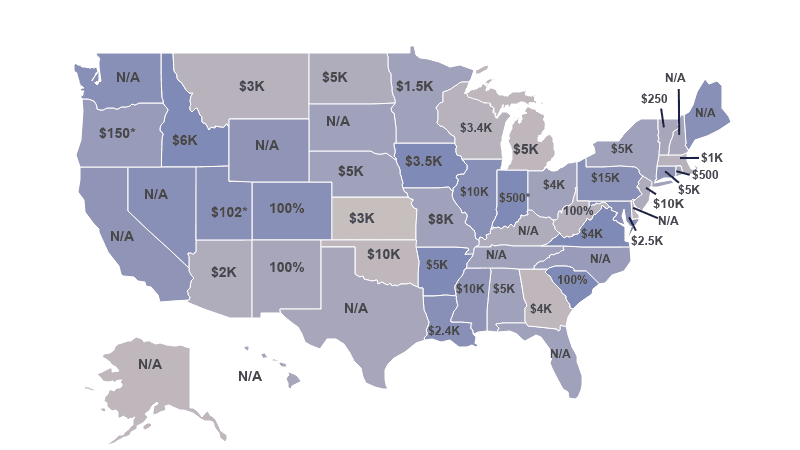

New Jersey No Yes Beginning with the 2022 tax year maximum deduction of 10000 per taxpayer per year for taxpayers with gross incomes of 200000 or less that contribute to New Jerseys 529 plan Contributions made before 2022 tax year are not deductible New Mexico No Yes Contributions to New Mexico 529 plans are fully deductible. On top of the tax benefits there are a number of other college-related benefits for New Jerseyans. Investments in NJBEST are not insured by the FDIC or any other.

Say I have qualified education expenses of 10000 and I take a withdrawal of 10000 from a 529 Plan and 1000 are earnings. Two 529 Savings Plan Options The more you can save through a 529 plan the less stress youll have when its time to apply for financial aid or search for scholarships. To get started you can deposit 25.

New Jerseys direct-sold 529 college savings plan helps families invest in their childrens future education by starting out with as little as a 25 deposit. Open the account with 1200 or contribute a minimum of 300 for each year that you want to earn credit in the table above. NJ tax treatment of 529 Plan earnings.

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

New Jersey 529 Plans Learn The Basics Get 30 Free For College

Usa 529 Plan Tax Savings 2019 How To Plan Tax Credits Tax Deductions

How Do I Choose A 529 Morningstar 529 College Savings Plan Saving For College How To Plan

Nj College Affordability Act What You Need To Know Access Wealth

529 Tax Deductions By State 2022 Rules On Tax Benefits

Franklin Templeton 529 College Savings Plan New Jersey 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Njbest 529 College Savings Plan New Jersey 529 College Savings Plan Ratings Tax Benefits Fees And Performance

How America Learns By The Numbers Flowingprints Educational Infographic Data Visualization Infographic Infographic

New Jersey 529 Plan And College Savings Options Njbest

Njbest 529 College Savings Plan New Jersey 529 College Savings Plan Ratings Tax Benefits Fees And Performance

10 Things Every New Jersey Family Should Know About College Savings

Clueless About 529 Plans Here S A Guide Nj Com

New Jersey Nj 529 Plans Fees Investment Options Features Smartasset Com

529 Tax Benefits By State Invesco Invesco Us

Nj Able New Jersey 529 College Savings Plan Ratings Tax Benefits Fees And Performance

You Don T Need To Be A Hockey Pro To Score This Game Winning Goal Mesp Is Michigan S Direct 529 College Savings Plan Saving For College College Savings Plans

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance